Shanghai Disney: Expert Views

Disney’s innovative pricing strategy is a first for the country and its set to educate the market, says AECOM’s Chris Yoshii

Shanghai Disney Resort includes a number of firsts for theme parks in China. Online ticket sales began 28 March and ticket sales were brisk. Online tickets are being sold for specific dates which is a first for theme parks in China.

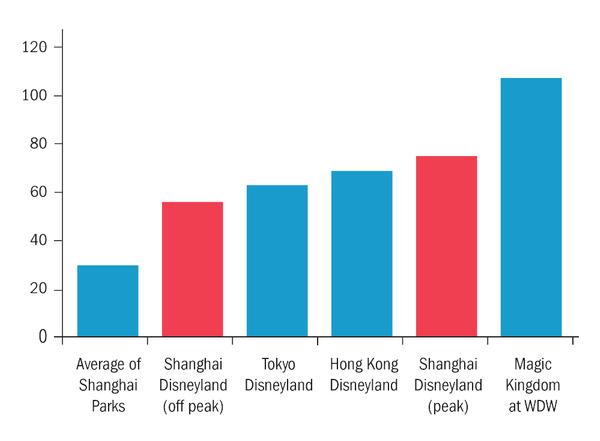

Furthermore, Shanghai Disney is breaking new ground in offering a two tier ticket price system for peak and non-peak days. Peak day tickets sell for RMB499 ($75) and include the park opening period, weekends and holidays. Non-peak tickets sell for RMB370 (US$56) for adults which is a significant price differential and intended to entice people to non-peak periods.

When compared to other theme parks and amusement attractions in Shanghai, Disney is priced well above the average, at double the local competitive price. While the Disney product offering and quality is well above others in Shanghai, it’s a bold move. Also of interest is that Shanghai Disney off-peak and peak price straddles the prices at Tokyo Disneyland and Hong Kong Disneyland (see Table 1). To some extent Tokyo Disneyland pricing appears low due to the low exchange rate of the Japanese yen. Nonetheless, the fact that a park in China would attract a higher price than Japan or Hong Kong is a stunning statement of the strength and depth of the market.

Date-specific tickets

With the exception of a few waterparks, variable pricing is not common in Asia. Samsung Everland’s Caribbean Bay in South Korea and Chimelong Waterpark in Guangzhou offer reduced price shoulder season tickets, which makes sense given the relatively short operating seasons and very high peak demand for waterparks. By starting out of the gate with a variable pricing system, Disney is educating the market and setting a new standard.

Issuing date-specific tickets is also a first and is meant to avoid the problems that plagued Hong Kong Disneyland’s opening period when large amounts of undated tickets were sold and beyond-capacity crowds showed up during the spring festival. However, unwary customers are bound to show up on the wrong date and people will want to change dates due to schedule changes or weather forecasts. Chinese travellers are quick to voice their opinions through their ubiquitous social media channels so handling these inevitable difficulties will be a challenge.

Expansion plans

Disney is building an entire resort complete with two hotels, a retail, dining and entertainment district and park lands. The 420-room Shanghai Disneyland Hotel has an art deco motif while the 800 room Toy Story hotel is family oriented. The retail dining and entertainment area, Disneytown, has a wide range of offerings. The headline for the entertainment will be a 1,200 seat Walt Disney Grand Theatre showcasing The Lion King in Mandarin.

Furthermore, Disney is already planning expansions with notable capital budget increases to accommodate increased capacity. Behind the scenes, furious work will continue as the crews create more Disney magic.

The opening of Shanghai Disney is a watershed event in China’s theme park industry. We’re often asked how local parks will be impacted and respond. History tells us parks that are proactive and differentiated from Disney can not only survive but thrive. A case in point is Ocean Park in Hong Kong which, upon learning of Hong Kong Disney coming to town, began a comprehensive and aggressive $700m (£480m, €623m) investment programme to upgrade facilities and add capacity. Ocean Park has also been able to slowly increase prices while staying under the Disney price level. The results have been spectacular with attendance doubling in 10 years, while Hong Kong Disney also thrived. Instead of splitting the pie, the pie grew much larger.

All in all, the themed entertainment industry is invigorated by Shanghai Disney. While there’ll be unanticipated challenges and complaints, it’s a major event for Asia and an indication of more to come.

Table 1: Adult Headline Price in USD

Chris Yoshii is president of the TEA’s Asia Pacific Board and head of business development at AECOM.

www.aecom.com

Recreation Assistant (Dry Site)

Party Leader

Recreation Assistant/Lifeguard (NPLQ required)

Fitness Consultant Grade 3

Commercial Manager

Receptionist

General Manager

General Manager

Swim Teacher

Customer Service Advisor

Team Leader

Swim Teacher

Swimming Teacher

Swimming Teacher

Company profile

Featured Supplier

Property & Tenders

Company: Jersey War Tunnels

Company: Savills

Company: Cotswold Lakes Trust

Company: Knight Frank

Company: Belvoir Castle